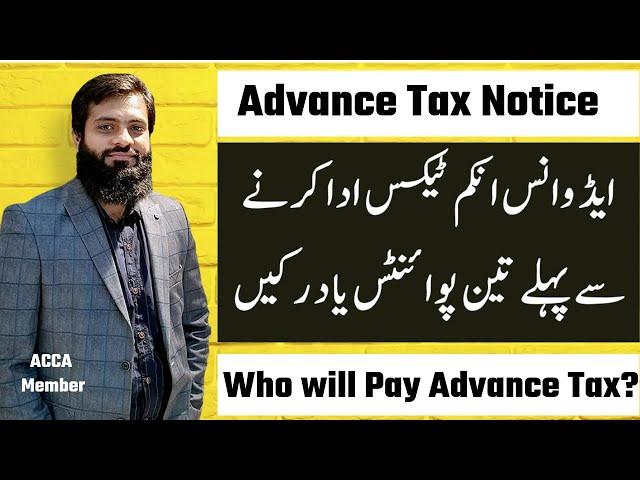

Advance Income Tax | Who will pay | How to calculate | How to Reply | Exemption | FBR |

Комментарии:

Sir Kayya 236 C Or 236 K Ko Next Year Jis Mayn Property Purchase Ke Ha Ya Sale Ke Ha Os Ko 2nd Year Ya 3rd Year Mayn Adjist Kayya Ja Saktha Ha Plz As Par Agar Koi Video Ha To Plz Woh Send Kar Dayn

Ответить

AoA sir Tax Rate is 1.5% or 1,25% ????

Ответить

AoA

Thanks for the highly informative vlog. My question is why assesses not falling under Adv Tax section are being constantly served notices ( profit of Behbood and Pension Accounts with income less than 5 mn)

What will the status of WH Tax deducted by the customer during the quarter. Is this deduction will consider as advance tax or not for that respective quater calculation.

Ответить

Sir, I have sold a property file ,declared as property asset in previous returns, with a Gain of 5 lakh, is this gain taxable? And where to show this gain in returns?

Ответить

Assalamualaikum

Sir ap ne kaha tha abi IT file na kren kuch din wait kren date extend ho gi. Lekin ap ne dobara is topic pr video nai banai... Kindly is baray mn video banaye return jama krayen ya wait kren aur portal pe mazeed koi masla hai ya nahi.. thanks

Dear Faheem Sb,

I have seen your videos. MashAllah you explain very well. I have one question and I will appreciate it if you can respond:

I have received notice u/s 147 and it shows total tax liability for the year Rs.80,000 and for this quarter is Rs.20,000. However, I have paid tax Rs.33,000 (deduction at source) for this quarter.

Now I will put 33,000 in adjustments or just 20,000. When I put 33,000 it does not show 13,000 excess paid it just makes tax liability zero. instead. Please guide. Many thanks

Sir kia karachi yani outside Punjab main bhi 7e yani deem income form main fair market value kia cost he likhi jaye jee karachi main out side punjab? Thanks sir

Ответить

AOA sir

May ny aik chez pochna ta k capital value tax on vehicles (CVT) adjustable ha k nh agr ha to IRIS may hum ny kaha py adjustment krni ha

Aoa sir

As I had asked earlier also in coments of your video lec about Punjab High Court decision in which you clarified that cost value & fair market value are to be filled same in the property of 7E form. Can we use this formula for Islamabad plots also or otherwise. Requested for reply.

Sir but in case of AOP/COM notice received from FBR they avoid this A*B/C-D formula and tax compute on accounting profit what is that plz explain

Ответить

If after 3 years maturity, profit on National saving certificate more than 5 million, will be treat in normal tax, it will also be paid advance tax next time ? it will only one time after 3 years

Ответить

Good work bro, My question is Suppose, if a withholding agent miscalculate the tax of employee on income by mistake. please explain about this situation. who pay the tax difference withholding agent or employee and what is the consequences.

Ответить

Asslamolaikum

I am retired person. My source of income is only BEHBOOD CERTIFICATE .Yesterday i received notice U/S 147 to pay advance income tax.please guide whether i have to pay the same or not?

Thanks

Falt purchase Kiya year 2020 secoend flat sale kiya 2020 ma per return ma likh na bhol gaya ap year 2023 ma return ma kasa likh please guide karh

Ответить

AOA- Received a notice of Advance Tax u/s 147, In PLS Saving Account Tax deducted after every six month along with bank profit, in that case how can we calculate/estimate Advance Tax u/s 147 in this scenario . Thanx

Ответить

A private limited company were deducting the monthly tax of its employees but in the last month of June of the fiscal year company estimated the outstanding tax which was wrongly miscalculated and the withholding agent deducted less than the actual tax in June which is last month of fiscal year. Now the remaining tax of fiscal year is paid in June (wrongly calculated tax less than actual) which was less then the actual tax and fiscal year is end. what are the consequences and who will pay the remaining tax and how ?

ایک کمپنی (پرائیویٹ لمیٹڈ)نے ہر مہینے ملازمین کا ٹیکس کاٹا (tax deduction at source) مگر fiscal year کے آخری میں جب کمپنی نے بقایا ٹیکس کی final calculation کرنی تھی تب اس نے ٹیکس کا تخمینہ لگایا جو جون کے مہینہ میں کاٹا گیا مگر غلطی سے وہ کم ہوگیا۔ اب مالی سال ختم ہوچکا ہے اور کمپنی نے دیکھا کہ جون کے مہینہ میں جو ٹیکس جمع کروایا تھا وہ کم تھا اب مالی سال ختم ہوچکا ہے اور کمپنی نے اگست (نئے مالی سال میں )کے مہینہ میں یہ بات نوٹ کی کہ ٹیکس کم کٹا ہے اب اس صورت حال میں جو ٹیکس کم کٹا اس کو کون ادا کرے گا ؟ اور کیا ایف بی آر کوئی جرمانہ عائد کرے گا ؟

My Exam Question given by My Teacher... Need help with some references and straight answer.

FBR plans crackdown against cash transactions in real estate

Buying real estate worth more than Rs 5mn using cash or a bearer cheque will be subject to a penalty equal to 5% of the property's value LAHORE: In another attempt to shore up tax collection and monitor money trails in the vastly untapped real estate sector, the Federal Board of Revenue (FBR) is taking steps to address the widespread use of cash transactions. Senior FBR officials have revealed their intention to implement strict penalties and improved monitoring measures to ensure compliance with these regulations.

Back in 2019, an amendment, Section 75A, was introduced into the Income Tax Ordinance, 2001. This amendment stipulates that no individual should acquire immovable property with a fair market value exceeding Rs. 5,000,000, or any other asset valued at more than Rs. 1,000,000, except through the use of a crossed cheque issued by a bank, a crossed demand draft, a crossed pay order, or any other crossed banking instrument that substantiates the transfer of funds between bank accounts.

In addition to their earlier information, they also informed that the fair market value of immovable property will be determined either by the Board, as specified in subsection (4) of section 68, or by the provincial authority for stamp duty purposes – whichever amount is higher.

However, if the transaction doesn’t adhere to the specific banking methods outlined earlier, there are significant implications: Firstly, individuals engaging in such transactions won’t be eligible to claim deduction. This means that deductions related to aspects like depreciation, initial allowance, intangibles, and pre-commencement expenditure will not be permitted for assets purchased outside of the specified banking channels.

Secondly, any cash amount used for a purchase that should have been conducted through the prescribed banking channels, as mentioned previously, will not be considered as a cost when calculating any gains resulting from selling such an asset, as per the stipulations of section 76.

Additionally, if someone buys real estate worth more than five million rupees using cash or a bearer cheque, they’ll be subject to a penalty equal to 5% of the property’s value. This value will be determined either by the Board, as specified in subsection (4) of section 68, or by the provincial authority for stamp duty purposes, depending on which one is higher.

The official also explained by giving example that if a person wants to buy a house worth 6 million Rupees. Instead of following the rule in Section 75A, the person decides to pay the seller in cash. In this case, the said person is violating Section 75A because he or she’s purchasing an immovable property worth more than 5 million Rupees using cash, which is not allowed under the law.

The official also added that it’s a common practice for many of us to disregard these rules. This is because there are numerous property dealers involved in buying and selling properties who are neither registered nor fully aware of the laws. On the other hand, there is a prevailing preference among people for cash purchases in real estate, especially for properties that cost less than ten million.

“Discussions have taken place within the board on several occasions regarding the need to penalize those engaging in such transactions. Now, a plan is being implemented in which property transactions in areas notified by the FBR will be closely monitored, and those who violate the rules will face penalties,” he concluded.

❤

Ответить

AOA,

Sir please provide excel sheets for quarterly advance tax calculation and final tax calculation.

How doctors can respond this query. He has 25% salaried income and 75% service income u/s 153 1 (b).

Ответить

Jo hmara refundable prha Huwa Woh kidher jana phir ? In ko bhe abhe day day filer r refund bhe prha Huwa

Ответить

As already discussed on whatsapp regarding advance tax .........kindly explian.....1- how to calculate advance tax for 2nd qtr (individual tax payer)...e.g latest tax =50000....using formula 50000/4=12500-B (tax already paid)....so in 2nd qtr ...the amount of Rs.12500 is already paid in 1st qtr ( july to sep 2023,for tax year 2024). will it be zero for 2nd qtr ? kindly explain.......regards Ali.

Ответить

Sir, my income from profit on debt (bank savings account and NSC certificates) in 2023 was more than 5 million, so I paid under normal tax. I have received a notice under secion 147. How should I reply to the notice? Please guide

Ответить

Bohat achi video❤

Ответить

Mashallah jee

Ответить

Sir need clarification on sales tax on contractors/construction conyracts? Is 50M is the the lower limit to charge sales tax? Is it a provicial subject after 18th ammendment?

Ответить

Sir g tax credit Kon sy lengy individual ki case man

150 151 152 154 155 section ki ly saky hy k nai

Sir g tax credit Kon sy lengy individual ki case man

150 151 152 154 155 section ki ly saky hy k nai

Sir g tax credit Kon sy lengy individual ki case man

150 151 152 154 155 section ki ly saky hy k nai

Sir g tax credit Kon sy lengy individual ki case man

150 151 152 154 155 section ki ly saky hy k nai

Sir g tax credit Kon sy lengy individual ki case man

150 151 152 154 155 section ki ly saky hy k nai

Bast lecture faheem bahi

Ответить

Faheem Bahi a vehicle of 3 million is purchased for business,can its input be claimed?

Ответить

Dear sir how to become active tax payer list not filed sales tax more than six months

Ответить

اگر مجھے بطور پر چیزر کسی سپلائر کو ایڈوانس پے منٹ کرنی ہو تو ایڈوانس دیتے ہوئے کون کون سے ٹیکسز چارج کرنے ہونگے؟ وڈ ہولڈ کرینگے یا نہیں؟

Ответить

Sir my saving account and NSC profit last year was more than 5 million, and FBR sent me advance tax 147 notice in December and March which I paid. So far no notice for June.

Do I pay advance tax for june?

For this year my profit on debt income will be more than 5 million.

Please advise.

Ye tax un Jahan governments logon ko facilitate kerti hy. Yahan TU awam ko Sirf lota jata hy. Gareeb awam ko mushkil mei Dala Howa hy.

Ответить

Ma salaried hun lekin mere stormfiber bill ma advance income tax b kata hai aur sales tax bhi. To ye kis codes ma enter hongay? Salaried ky lea advance income tax refund hojata hai?

Ответить

امپورٹر ايڈوانس ٹيکس کيسے ادا کرے گا اور کيسے ايڈجسٹ کرے گا

Ответить

Sir advance tax 147 jama krwa dya tha Ab annual return ma kaisy adjust krain ??

Ответить

is it also for senior citizens having income only from behbood certificates if income is more than 1.00 M from profit of the said certificate

Ответить

Assalamualaikum

Faheem bhai

Kya private limited company ki annual return or form every year secp mai deposit hotey hain ?

Assalamualaikum

Faheem bhai

Kya private limited company ki annual return or form every year secp mai deposit hotey hain ?

I replied notices of quarterly advance tax but all are in the outbox please suggest what should i do ?

Ответить

147 pay Advnace tax notice for a salaried person, should we ignore?

Ответить

@Faheem Mehboob sahib, according to Circular in 2017 on Bahbood savings/Pensioners benefit account , tax is to be paid at the time of filing of return not in advance , you have said in your lecture tax will be paid in advance how do you justify this. Explain

Ответить

Sir,

If tax deducted on supplies (sales) u/s (153 1(a)) then also we have to pay advance income tax (147). And if it is, what is its working to calculate.

Regards,

Sir app ka office kha ha

Ответить

Is advance tax applicable on rental income

Ответить

![No Escape (1994) ORIGINAL TRAILER [HD] No Escape (1994) ORIGINAL TRAILER [HD]](https://hdtube.cc/img/upload/Z0pQbnN4bEF1QXU.jpg)