6 Tax breaks every homeowner should know about

Being a homeowner is great, but saving on taxes? Even better! Here are 6 tax benefits every homeowner should know about:

1️⃣ Mortgage Interest Deduction

Did you know the interest you pay on your mortgage could lower your taxable income? It’s a major perk of homeownership, so be sure to grab Form 1098 from your lender to claim this deduction!

2️⃣ The Augusta Rule

This little-known tax rule allows you to rent out your home for up to 14 days a year—completely tax-free! Whether it’s Airbnb or a short-term rental, you don’t need to report the income. Use those extra earnings however you’d like!

3️⃣ Property Tax Deductions

Depending on your state, you can deduct up to $10,000 ($5,000 for singles) in property taxes. Keep an eye on your local tax rules to make sure you’re getting the maximum deduction possible.

4️⃣ Home Equity Loan Deduction

If you’ve used a home equity loan to make improvements, you might be able to deduct the interest on that loan. It’s a great way to ease the cost of home renovations while saving on your taxes.

5️⃣ Capital Gains Exemption

Thinking about selling your home? If you’ve lived there for at least 2 of the last 5 years, you can exclude up to $250K ($500K for couples) of capital gains from taxes. This is a huge advantage for homeowners looking to sell!

6️⃣ Home Office Deduction

For those working from home, you can deduct a portion of your home’s expenses based on the area you use as an office. Everything from maintenance to utilities can be written off, helping you lower your tax bill while running your business from home.

❤️ Like this post and 💾 save for future reference. Know someone who could benefit from this? Share it with them now!

Follow → @jjwilferth for your daily mortgage and financial wellness tips‼️

#MortgageBrokerLife #HomeBuyerTips #FirstTimeHomebuyers #MortgageAdvice #HomeOwnershipGoals #SmartInvesting #DreamHomeGoals #MortgageSolutions #KCMortgageLender

1️⃣ Mortgage Interest Deduction

Did you know the interest you pay on your mortgage could lower your taxable income? It’s a major perk of homeownership, so be sure to grab Form 1098 from your lender to claim this deduction!

2️⃣ The Augusta Rule

This little-known tax rule allows you to rent out your home for up to 14 days a year—completely tax-free! Whether it’s Airbnb or a short-term rental, you don’t need to report the income. Use those extra earnings however you’d like!

3️⃣ Property Tax Deductions

Depending on your state, you can deduct up to $10,000 ($5,000 for singles) in property taxes. Keep an eye on your local tax rules to make sure you’re getting the maximum deduction possible.

4️⃣ Home Equity Loan Deduction

If you’ve used a home equity loan to make improvements, you might be able to deduct the interest on that loan. It’s a great way to ease the cost of home renovations while saving on your taxes.

5️⃣ Capital Gains Exemption

Thinking about selling your home? If you’ve lived there for at least 2 of the last 5 years, you can exclude up to $250K ($500K for couples) of capital gains from taxes. This is a huge advantage for homeowners looking to sell!

6️⃣ Home Office Deduction

For those working from home, you can deduct a portion of your home’s expenses based on the area you use as an office. Everything from maintenance to utilities can be written off, helping you lower your tax bill while running your business from home.

❤️ Like this post and 💾 save for future reference. Know someone who could benefit from this? Share it with them now!

Follow → @jjwilferth for your daily mortgage and financial wellness tips‼️

#MortgageBrokerLife #HomeBuyerTips #FirstTimeHomebuyers #MortgageAdvice #HomeOwnershipGoals #SmartInvesting #DreamHomeGoals #MortgageSolutions #KCMortgageLender

Комментарии:

Harmony in Havoc

Musik für die Ewigkeit

泰國水燈節最新消息!驚現芭堤雅T21機場大水浸!?【Ahli and Fan 窮退泰無憂】

Ahli & Fan 窮退泰無憂

Shri Ram Chandra Kripalu Bhajaman - Shri Satya Adhikari

Soul of Hogwarts

英议员在议会引用毛语录讥讽对手

美国之音中文网

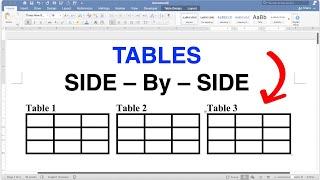

How To Put Tables Side By Side In Word

Abhay Zambare

Мавзолей Негоша и гора Ловчен

Денис Зоткин

LOCKING BLADES on Custom SAKs?? Done.

Fit to Survive

Street Walk Santiago (Ñuñoa) - Chile - 4K

World Walking Tours

New Zealand Girl Reacts to BARRY SANDERS TOP 50 PLAYS IN THE NFL

Courtney Coulston

![Ti Gérard [Ft. Delly François] - System Band Live à Paris (2001) Ti Gérard [Ft. Delly François] - System Band Live à Paris (2001)](https://hdtube.cc/img/upload/NHV1MS1UTFBfeE4.jpg)